Getting dumped for another lender happens, but responding strategically to the client’s reasons for making the switch is just as important as your script when engaging with the prospect for the very first time.

The majority of the population loathes change and feels quite insecure and hesitant when faced with switching gears for any reason. Once the change is made, the smallest glitch or bump in the road will cause most people to regret their decision and wish they hadn’t made the change at all.

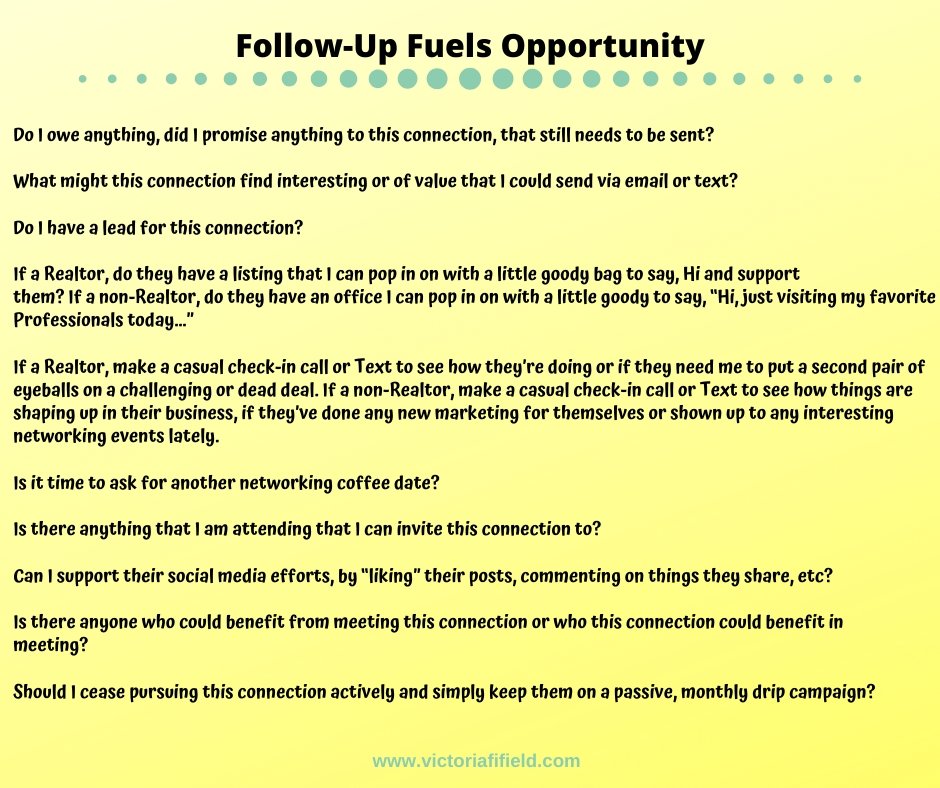

In the case of obtaining a mortgage, there can be plenty of moments of uncertainty and insecurity for the borrower, so the likelihood is when you do get dumped for another lender, there’s a real possibility of wooing your prospect back if you just gracefully and strategically keep the door open and follow-up.

Just recently I helped a client of mine write the following email script to send to her straying customer. In this particular case, the loan officer had given advice, consistently checked-in and been an ear to this prospect’s personal challenges over a significant period of time, yet the prospect decided to go with her credit union based on, “convenience.”

Ouch! Right?

Of course, this is just one way to respond, BUT what I like to remind my clients when responding to rate shoppers or getting dumped for other reasons is…

1. You are NOT desperate-Let ’em go gracefully and keep the door open.

2. You are the BEST choice regardless of their reason.

3. Remember, the prospect has NO idea what they should really be worried about, like actually making it to the closing table and CLOSING.

Feel free to adopt, edit and use the following script as you see fit.

“So happy to hear things in your personal life are just about wrapped up for you. Onward and upward, right? Congrats!

Please do keep in mind that not all mortgage services are the same, so if for any reason things start to go sideways with the process or communication with your credit union, do not hesitate to contact me ASAP. Starting the loan process is easy, but getting to the finish line and closing your loan is where experience, solution-based thinking and perseverance is a must. I can honestly say I’ve saved dozens and dozens of deals from falling apart in my 20+ years of lending.

I’d love the opportunity to help you into your bright future with a brand new home. Again, if anything changes, just call me immediately. I’ll make sure to check in on you in a few weeks to see how all is coming along.

Take care out there and stay in touch.”