Ask any Realtor or Loan Originator and they will tell you, 2022 has had its slew of challenges. Most will say their sales are down and so too are their spirits. However, there is a massive difference in HOW individual professionals tackle a challenging sales environment and either continue to thrive or wane under the weight of a market upheaval.

Ask any Realtor or Loan Originator and they will tell you, 2022 has had its slew of challenges. Most will say their sales are down and so too are their spirits. However, there is a massive difference in HOW individual professionals tackle a challenging sales environment and either continue to thrive or wane under the weight of a market upheaval.

Want to come out on top even when you feel the chips are down? Step into the shoes of today’s ultra producers and leap into the top 10 things they do, no matter what the market does…

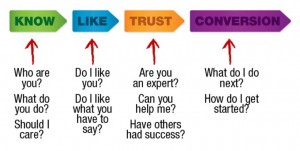

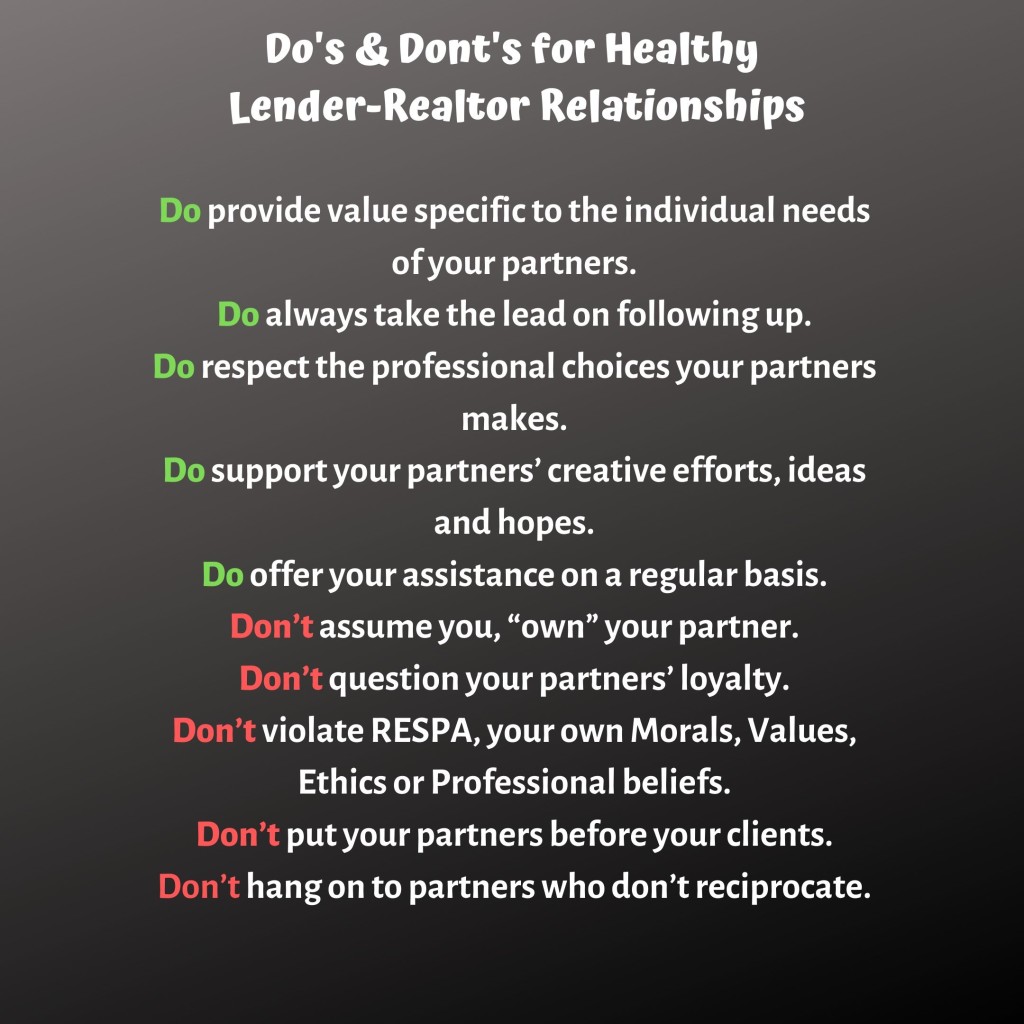

1. They call on their stable of connections (e.g. referral partners, past customers, peers, networking acquaintances, vendors and service providers they utilize, friends & family members).

2. They add to their stable of connections by showing up (e.g. business networking events, industry-specific events, educational events, Community outreach/volunteer activities, sales rallies/sales seminars, social gatherings.)

3. They set time aside daily to prospect.

4. They act on opportunities now, rather than later and are always, first, to follow up!

5. They plan to succeed by having goals that are written down and/or a business plan that is revisited frequently.

6. They track their numbers and adjust accordingly (e.g. lead to close conversion ratio, units & volume, marketing expenses and R.O.I, other business expenses, time spent on high-value activities).

7. They combat negative messaging with positive messaging of their own via conversations, social media engagement, email, text, and video.

8. They share ideas with their peers, and they ask for ideas from their peers.

9. They choose to feel determined rather than desperate.

10. They invest in themselves by way of education, coaches/trainers/mentors and technology.

Recent Comments