Funny thing about finally finding that elusive thing called, “down time”….Once we get some we either A) Choose to do nothing with it. B) Choose to fill it up with non-productive tasks or C) Forget what it was that we swore we were going to accomplish when we did finally get some, in which case A and/or B come into play. So in an effort to encourage the best of the best to use their down-time to catapult their careers, here is a memory jogger list of high pay-off projects to consider…

Funny thing about finally finding that elusive thing called, “down time”….Once we get some we either A) Choose to do nothing with it. B) Choose to fill it up with non-productive tasks or C) Forget what it was that we swore we were going to accomplish when we did finally get some, in which case A and/or B come into play. So in an effort to encourage the best of the best to use their down-time to catapult their careers, here is a memory jogger list of high pay-off projects to consider…

Get socially savvy-Create Lists in Facebook for your, “Friends” who happen to fall into certain critical categories, such as: Realtors, Past Customers, Prospects, Peers, Teammates and Other Referral Partners so that you can control who sees certain posts and make your posts even more relevant to your specified audiences.

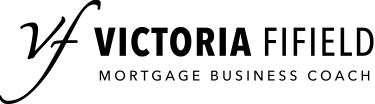

Embrace efficiency-Get your Realtors and other referral partners, past customers, old prospects and new prospects , plus all of those forgotten business cards into your CRM, into your online email marketing portals, into your smart phone and any gift-giving online stores’ address books, such as Amazon, Shutterfly, Send out Cards, etc.

Just do it!-Don’t have a CRM that houses all of your various contacts? NOW is the time to research them on-line and get your most precious business asset (your contact list) organized and receiving branded, pertinent information from you on a regular basis. Remember, just because someone works with you once, doesn’t mean they are going to remember to refer you, use your services again or reach out to you with questions, UNLESS you are top of mind.

Brush-up on your craft-What could you become better at in your career? What experience do you lack? What aren’t you comfortable talking about? What part of your business still has you stumped? What could you read, listen to or take an on-line class about that would give you that edge?

Coordinate creativity-A cluttered outer world clutters our inner world. Do you have files to purge, emails to organize, subscriptions to cancel, files to shred or store? We ALL DO at some level and this is a GREAT time to declutter, reframe, refresh and create space. Remember, creativity is at the crux of all thriving careers and creativity can’t spread its wings if there’s not enough space to take flight.

Now, I’m not saying NOT to take advantage of some of this down time by indulging in non-business growth activities, such as: naps, long walks, game time with the family, binge watching Netflix shows, etc., What I want everyone to take to heart can be summed up in this quote just given to me earlier today by one of my clients and that is….“Champions are made in the off season!”

Recent Comments